How embracing advertising’s mindset keeps you poor.

How does being swayed by advertising keep you poor? By keeping half of you poor. I’ll explain.

You only live once. And many of us tend to live long. That long lifespan (say a 40-to-100-year time span) creates two different versions of you:

Today You and Future You.

You know Today You. Because that’s you, right now. You know where you live, how much money you have. Who you are in love with.

However, you don’t really know Future You. Will Future You be rich? Married? Where will Future You live?

Even though you don’t know a lot about Future You, it’s likely that you want Future You to be happy. To do that, you need to invest in Future You. It requires contributing, sacrificing and growing things about you now. Actions that require you to push some of what you own and let grow now into the future so the Future You can use your investments.

When you save and invest you help Future You.

It’s like putting your money or assets in a time capsule that you intend for Future You to eventually dig up and use. Along the way, thanks to what Albert Einstein called “the 8th wonder of the world,” compound interest, over 30 to 40 years, you can give Future You over 10X more money than you originally put in that fiscal time capsule. Imagine, if you put $10,000 in an investment account at 10% interest now. you can have $400,000 or more waiting for Future You in 2060.

I bet Future You will thank you for investing.

However, if you spend everything today, you’ll have nothing left to give to Future You. With that in mind, a lot of people are afraid for their future selves. According to a 2018 Gallup poll, more than half of Americans don’t expect to have enough for retirement. That’s 50% of people who believe they won’t have enough to support the future version of themselves.

Also according to Gallop, a big contributor to this situation is that many people and families in their younger years are in debt. So much, they can’t save enough to invest. In 2016, half of all millennials had less than $1000 in savings. Many more still are paying off car loans and school loans.

Debt is taking away things from Future You.

In fact, it’s actually sticking Future You with the bill for the things you buy today or already bought. You get to use them. Meanwhile, Future You has to find the money to pay for them. And likely has less money to enjoy their present (your future).

In order to save or not go into debt, it’s important to stop buying and spending everything we have today. As my dad once told me, “A millionaire is only someone who hasn’t spent their last million dollars.” In other words, don’t confuse what you make with what you save. If you know the fiscal history of once high-earning people like Mike Tyson, MC Hammer or most lottery winners, who had massive wealth and lavish lifestyles only to go broke, you know that’s true.

So why don’t we save? Put some money away for tomorrow? A big contributor is advertising and consumerism.

The power of now. Not the Eckhart Tolle way. The bad way. Advertising.

Lots of business have products and services. As they would like to get those products off their shelves and showrooms and converted back into money they can reinvest or draw profit from as soon as possible, they’d prefer if people dropped everything to buy it all today.

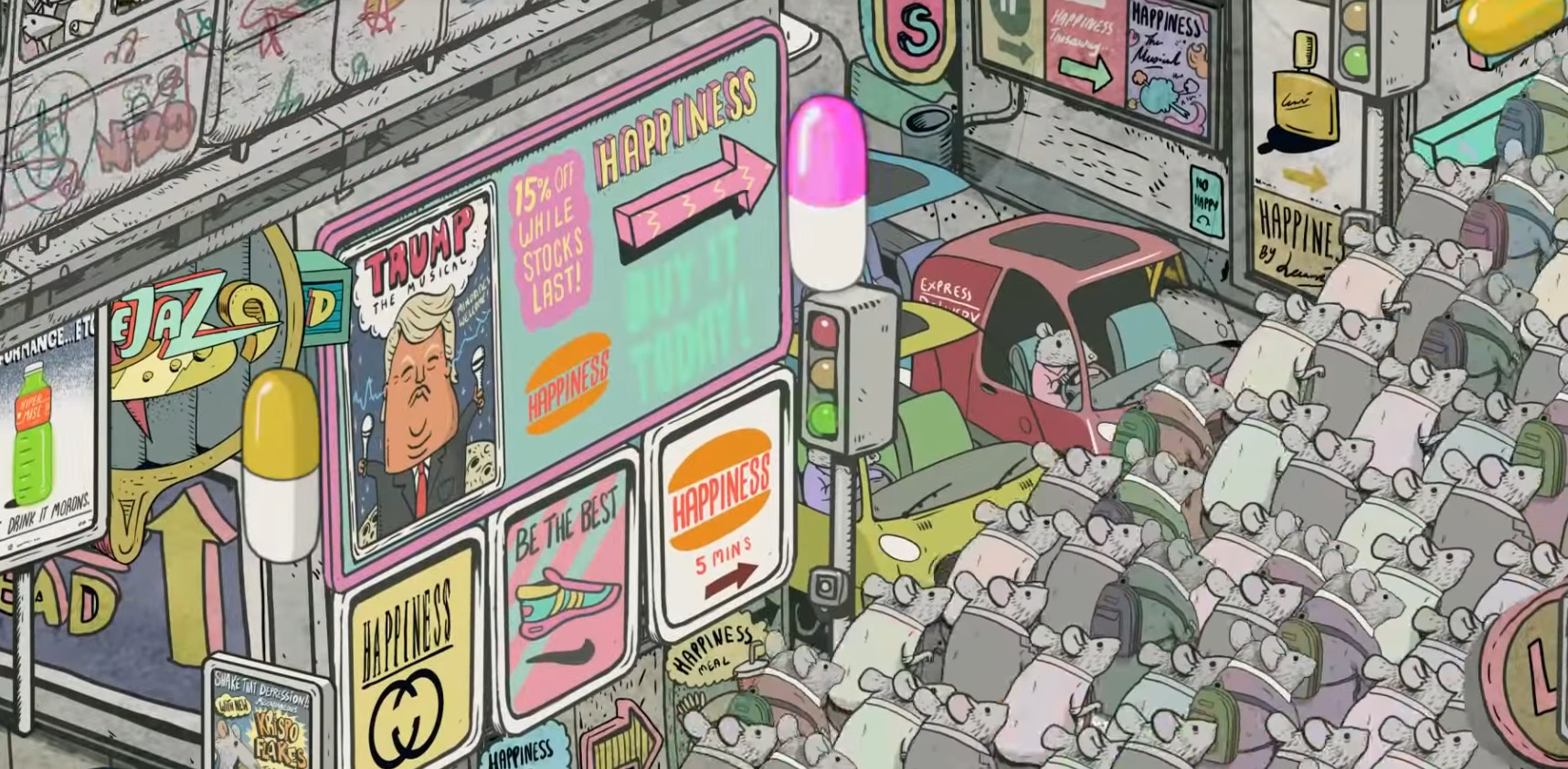

Advertising is a way to accelerate consumer purchasing. Rather than sitting around hoping a customer learns about their product by serendipity or when they feel like it, advertising interrupts your day or whatever you are doing with messages about the product that a business has available for you. Often communicated and framed with some kind of urgency. “Limited time.” “While supplies last.” “Be the first.”

Exposed to all those messages in totality around you, the world of advertising teaches you to live in the world of “don’t wait, buy now.”

If you adopt that value, you’re getting stuff you want. And I’m sure the stuff you buy is amazing. However, if you are converting most of your income into “stuff,” it’s usually trading long-term gains for shorter-term pleasure.

Remember our talk about Future You?

That iPhone. The new car. All the things around you are likely items and products that Future You will never see. Or see them when they are broken and unusable. What may not also be around for Future You? The money you used to pay for them.

If you are like most of us, like me, you often have regrets for some of the things you bought. Especially if Future You runs into hard times later and has to make harder choices, like scraping for money.

If you buy things you do not need, soon you will have to sell things you need. – Warren Buffet

Be mindful of being swayed by the advertising lullaby.

We have desires. We have self-restraint. But advertising is especially good at hacking those restraints, by making self-gratification, now, easy and no big deal.

Comedian George Carlin’s “Advertising Lullaby” shows how advertising sings soothing words and lyrics that serenades us to let go of our hesitation, willpower and just do it now.

“Quality, value, style, service, selection, convenience. Economy, savings, performance, experience, hospitality. Low rates, friendly service, name brands, easy terms. Affordable prices, money-back guarantee. Free installation, free admission, free appraisal, free alterations, Free delivery, free estimates, free home trial, and free parking.No cash? No problem! No kidding! No fuss, no muss. No risk, no obligation, no red tape, no down payment. No entry fee, no hidden charges, no purchase necessary. No one will call on you, no payments or interest till September.”

So get it, now.

It is so tempting. They’re telling us that it’s so easy to get the things you want, now. As they do, they make us forget what we may also want – or the trade off we’re making. A better life for Future You.

We’re not always good at looking at long-term benefits, even if they are better for us. A famous experiment confirms this.

The Marshmallow Experiment.

In the 1960s, Stanford professor Walter Mischel conducted a series of psychological experiments while observing the habits of children.

He brought in children around 4 to 5 years old, one at a time, into a room. A researcher had the child sit down in a chair. They then placed a marshmallow on the table in front of the child.

With the child seeing the marshmallow, the researcher offers the child a deal.

The researcher tells the child that they are going to leave the room for a few minutes. When the researcher returns and if they see that the child didn’t eat the marshmallow in front of them, they will reward the child with two marshmallows instead. If they eat the one marshmallow on the table before the researcher returns, that’s all they get. No second marshmallow.

The child’s choice was simple: one treat now or two treats later.

The researcher left the room for 15 minutes. Some kids ate one marshmallow immediately. Some struggled to restrain themselves but gave in. Some held off until the researcher came back.

The marshmallow experiment. Long-term findings.

While insightful as to who could delay gratification for 15 minutes, what was more insightful were the findings revealed as researchers, over 40 years, followed the habits of those who ate the marshmallow immediately against those who waited.

The kids that were able to delay gratification in the original marshmallow experiment reported having higher SAT scores, lower levels of substance abuse, lower obesity, better responses to stress, better social skills as reported by their parents.

The experiments seem to confirm that the ability to delay gratification is critical for success in life. They were able to sacrifice a little of today for tomorrow (Future You’s) benefit. So a good bet, their future selves are less likely to be suffering financially or be poor.

Buy it Today! Why wait? Here’s why.

Like holding off on marshmallows. Look at what you would have gotten if you held off.

Let’s say you want to retire in 30 years from today. Here’s the difference of buying an item for you or investing the same amount of money for future you for 30 years at 7% interest.

iPhone X $1500: Save and invest the money: $11,817.14

Trip. $2000.00 : Save and invest the money: $15,224.00

New Car $25,000: Save and invest the money: $190,306.39

And with the new car, you save more money as a car depreciates in value the minute you drive it off the lot and likely $1000 or more a year for maintenance.

Mindfulness can help you help Future You.

How can you overcome the impulse for self-gratification and save more?

A John Hopkins University study “Mediation Programs for Psychological Stress and Well-being” that included over 18000 citations, 47 trials with over 3000 participants, found that that mindfulness, learning to focus on the present, can help you reduce issues like stress or boredom. Often factors that make us shop as a form of therapy or emotional soothing. It also found that mindfulness can help you create a better work ethic and even improved financial habits that can drive your savings.

Or get it off your mind. Or needing to being mindful of money. Automate.

Set up your bank account or savings account to automatically save 10% or more of your income as soon as you get your paycheck. You probably won’t even notice what you save. But Future You will.

When does now matter? Now. Make a change for future you that matters.

The faster you act, the more saving you money can work for you and be enjoyed by future you. Get started.

Hey, I wrote a book about being mindful in the new age of content.

Does This News Make You Look Fat? A book about media consumption and how the way we consume it makes us intellectually obese. Preview or buy the ebook at Amazon.