Tech platforms. The Venus fly trap for business and consumers.

What are tech platforms? For the layperson, think of them as digital real estate or the environment in which you can do work on or subscribe to for a service.

Technically, it’s a digital environment where a software application is executed. That software could be e-commerce software for transactions (like Shopify), chat (like Slack) or picture sharing, streaming video and more like you enjoy on Facebook or Netflix.

For businesses, platforms like Amazon, eBay, Facebook offer a lot of seductive benefits.

They are often free or cheap. They offer high customer exposure. The service offered is highly scalable to grow to meet demands. Very beneficial features.

So why should you be very careful about putting your business there? Because…

Your building mission-critical parts of your business on someone else’s property.

At first, the ease and power of integrating your business with platforms seems like a smart, strategic partnership. To some degree, it is. The low cost and scalability of their platforms offer an incredible level of distribution and exposure to help grow your business. It would be a lie to say that many businesses have not prospered under this arrangement.

One problem with platforms…

As these platforms have grown, they are revealing themselves to be not so much your partner as much as your business’ landlord and, eventually. a direct competitor. Meanwhile, you are on a digital property where you can become stuck and can’t afford to leave.

They control the property your business operates and receives precious revenue on. And if you don’t want to have your sales drastically cut, you can’t really move, protest, or negotiate a whole lot. So by default, they control your business.

The Venus fly trap platform closes.

On top of that (in addition to being on top of their platform), companies like Amazon and Facebook get a lot of data and analytics around your business. Data around sales and interactions are being recorded on their platform.

Your sales or customer data that they obtain helps them identify products and lines of business that they may want to move into. Or develop pricing strategies that could create market pressures that force you to lower your price and profit margins.

Reporting also shows that Facebook has bought up businesses based on analytical data it was able to get on them. It enabled them to see any possible competition to them and acquire them before other businesses could see their value.

Now reports say that Amazon has stopped supporting sales of product from smaller companies and suppliers with an eye of focusing on larger companies and vendors.

Snap. Goes the platform.

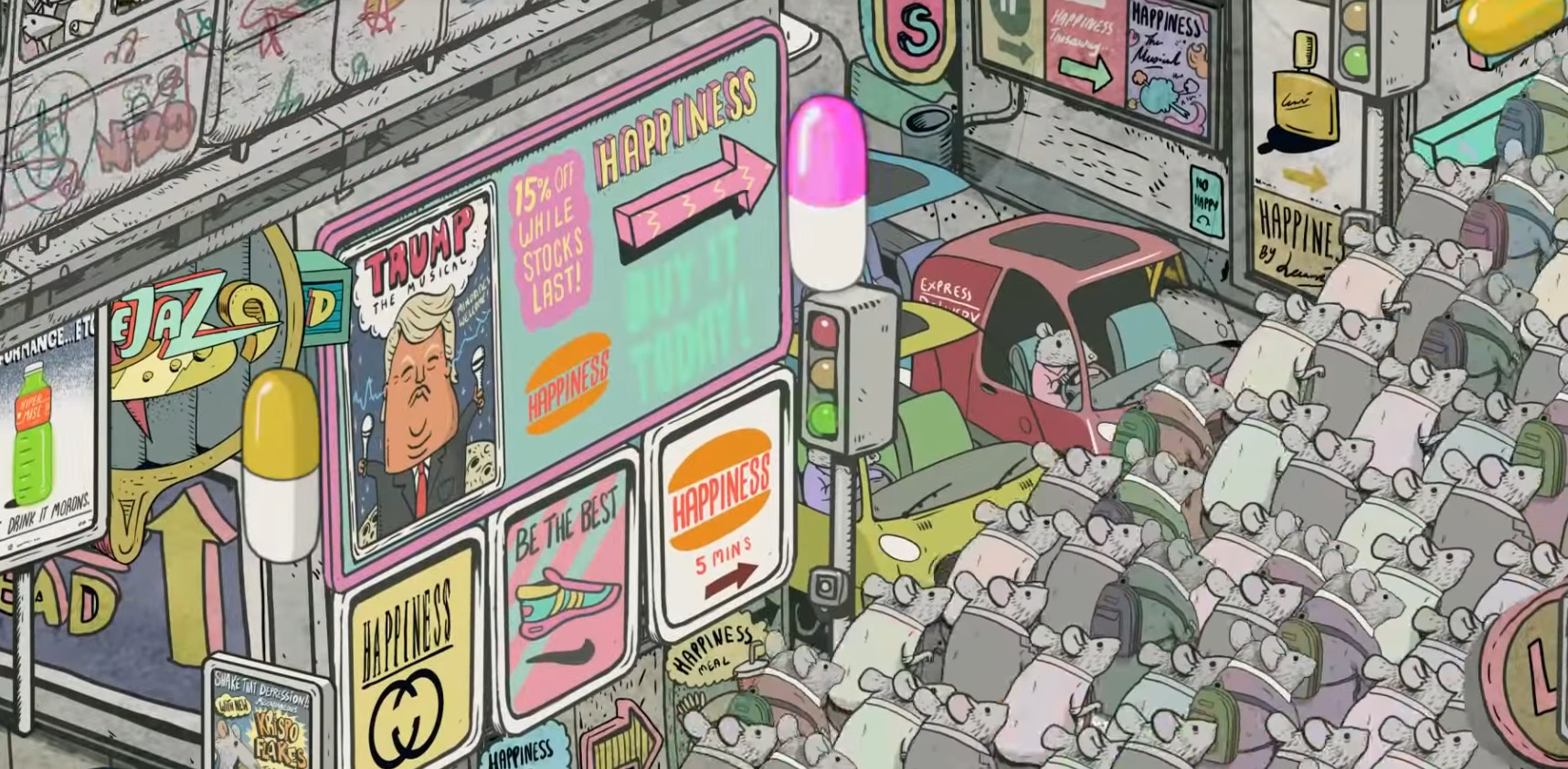

Consumers are on Venus fly trap platforms, too.

The same problem applies to content. Consumers are seeing it through the rise of subscriptions services.

Your music. Your TV. Your movies. These are things that were once a physical or intellectual property you could own in some form.

Then came subscription services. Like the Venus fly trap model, the lure for you to forgo or dump the idea of owning your content are these platforms’ low-cost and scalable access to content.

So you subscribe to Hulu, Netflix, Spotify, Apple Music, etc. to revel in that so much content is right at your fingertips.

But like business and Amazon, the platform is the landlord. While you pay rent, nothing is yours. The platform has only agreed to make it available for a time that is convenient to the parties that have control of the content.

Take Microsoft who recently closed its ebook offering. And with it, all the books its customers bought will simply evaporate. No reading. No refunds. Amazon temporarily pulled copies to the book 1984 from customers due to a rights dispute it was having with a publisher.

Snap goes the Venus fly trap.